Before GOP Tax Bill Takes Effect, Here are Some “To Do Items” for Corporations and Individuals

December 20, 2017

By John McDermott

By John McDermott

Partner; Tax Practice Group Leader

Taylor Porter

john.mcdermott@taylorporter.com

225.381.0261

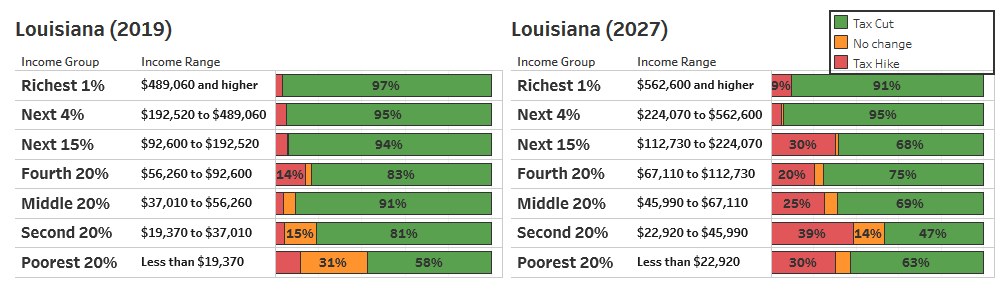

Projected Tax Bill Effects on Louisiana Residents 2019 vs. 2027

Source: Institute on Taxation and Economic Policy, CNBC

After passing through the Senate and the House twice, the first major overhaul of the nation’s tax laws since 1986, in the historic $1.5 trillion GOP tax bill, is expected to become law when United States President Donald Trump officially signs the legislation.

There are more than 500 pages of new rules and provisions, and the plan covers a 10-year span through 2027. The legislation permanently slashes the tax rate for corporations from 35 percent to 21 percent, and generally reduces individual tax rates.

Tax cuts for corporations would be permanent while the cuts for individuals would expire in 2026 to comply with Senate budget rules. The tax cuts would take effect in January, and workers would start to see changes in the amount of taxes withheld from their paychecks in February. Families making between $50,000 and $75,000 are expected to see average tax cuts of $890. Families making between $100,000 and $200,000 should have tax cuts averaging $2,260, while families making more than $1 million would get average tax cuts of nearly $70,000. (Associated Press).

Before this new tax law takes effect, there are several “action items” both corporations and individuals can do before the end of 2017 to take advantage of what will be down the pipeline:

- Make charitable contributions in 2017. The standard deduction increases significantly in 2018 and might cover all or a significant part of your regular charitable deductions, so make them in 2017 when you are more likely to maximize the benefit of a deduction for them.

- Most definitely pay all 2017 state income tax liability in 2017. The deduction for state income taxes goes away in 2018.

- Pay for investment advice and tax preparation in 2017 rather than defer to 2018. Deductions for those items go away for 2018.

- Defer business income into 2018 and accelerate business expenses into 2017 as much as possible. Tax rates go down in 2018, so income would be taxed at lower rates, while the benefit of a deduction is higher in 2017.

- If you plan to buy an electric car, get it in 2017 while the tax credit is still available. The credit expires in 2017.

- If you are moving or plan to move, do so and take moving expenses in 2017. The deduction for moving expenses will not be available after 2017. If you are due moving expense reimbursement from your employer, get it in 2017 while it is not counted as taxable income.

As the tax bill becomes law, we will continue to follow all of the rules and effects, and report our findings on our web site and blog, but if you have any questions or require additional information about the GOP tax bill, please do not hesitate to contact me at john.mcdermott@taylorporter.com

Disclaimer & Privacy

This website is for general information purposes only. Information posted is not intended to be legal advice. For more information, please see our Disclaimer message.

Read our Case Studies

See how we can help. Contact us today

- Disclaimer

- © Taylor, Porter, Brooks & Phillips L.L.P. All rights reserved.